Crane Time: Skilled Trades, Cost-Push Inflation, and Macroec onomic Friction

Labor scarcity, wage rigidity, and the limits of monetary policy

The United States construction sector faces a projected deficit of over half a million workers, yet certified crane operators remain disproportionately scarce (Bureau of Labor Statistics, 2023). This scarcity is neither incidental nor cyclical—it reflects structural labor market conditions. Compensation levels exceeding certain hourly rates, inclusive of benefits, are not anomalous; they are the rational outcome of limited supply meeting sustained demand (Associated General Contractors of America, 2023).

The Microeconomic Dimension

Cranes require operators with advanced certification, technical precision, and high tolerance for occupational risk (National Center for Construction Education and Research, 2023). Such requirements constrain the eligible labor pool. In certain jurisdictions, immigration enforcement concerns further suppress participation, thereby exacerbating shortages. The concept of wage elasticity is particularly visible here: remuneration rises until equilibrium is achieved, or projects remain stalled. The market response is direct, not speculative.

The Macroeconomic Dimension

Post-pandemic dynamics have intensified labor hoarding and skills mismatch. Employers retain qualified operators even during periods of reduced demand, elevating labor costs while constraining productivity (Associated General Contractors of America, 2023). Monetary tightening by the Federal Reserve aims to cool aggregate demand; however, structural shortages in skilled trades attenuate the transmission of policy. Put plainly, interest rates influence borrowing behavior, but they do not generate certified operators (Federal Reserve Economic Data, 2023).

“Interest rates influence borrowing behavior, but they do not generate certified operators.”

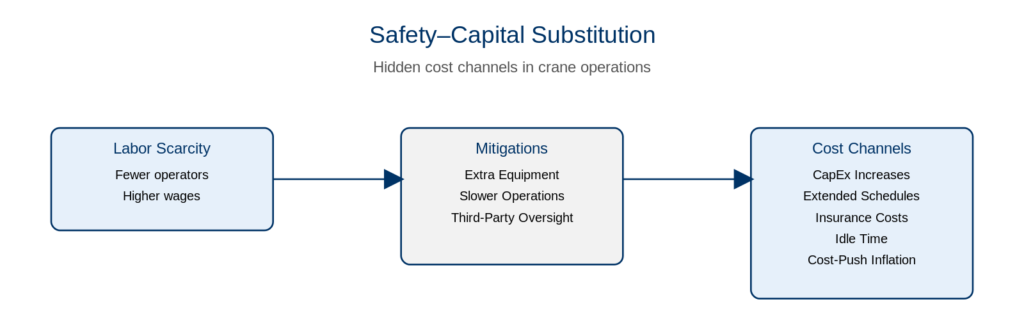

Safety–Capital Substitution and Hidden Costs

Key Insight: Safety costs do not vanish when skilled labor is scarce—they reappear as hidden capital and schedule expenses.

When skilled operators become scarce, companies do not simply accept elevated accident risk. Instead, they engage in capital-intensive risk mitigation—substituting additional equipment, slower operational parameters, and third-party oversight for human expertise (National Center for Construction Education and Research, 2023). These adjustments preserve safety outcomes but increase operational costs in ways that traditional productivity metrics miss.

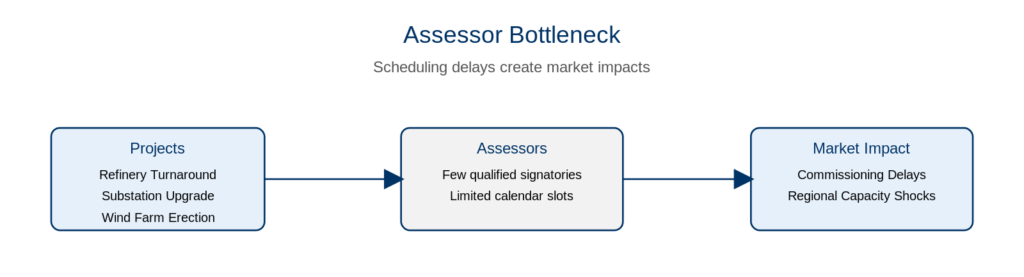

The Certification Bottleneck

An underexplored dimension involves the disproportionate influence of certification assessors and technical signatories. A small number of qualified assessors often constitutes the binding constraint on project commissioning and equipment deployment (National Center for Construction Education and Research, 2023). This creates synchronized “micro-cycles” where multiple projects compete for the same limited assessor pool, producing step-function changes in regional capacity tied to assessor availability rather than fundamental supply–demand factors.

Implications for Industrial Operations

- ✔️ Bids rise: Elevated wages, overtime, and per diem costs.

- ⚠️ Schedules slip: Limited operator availability stretches mobilization windows.

- 💰 Financing tightens: Higher rates plus higher wages reduce debt service margins.

- 📉 Productivity lags: Firms hoard scarce talent, slowing project throughput.

Conclusion

Together, these labor dynamics illustrate how construction costs and broader macroeconomic pressures are linked not only to wages but to institutional bottlenecks and hidden safety costs. For crane operations, this means inflationary pressure arises less from material scarcity than from skill scarcity and its downstream substitutions.

References

- Bureau of Labor Statistics. Employment Projections: Construction and Extraction Occupations, 2022–2032.

- Associated General Contractors of America. The Construction Workforce Shortage Continues in 2023.

- Federal Reserve Economic Data (FRED). All Employees, Construction in the United States.

- National Center for Construction Education and Research. Mobile Crane Operator Certification Standards.

Liam_P

Great insight. Well done.