Crane Time: Engineering Corporate Structure for Operational Advantage

Exploring how a modular corporate structure can align operational integrity, safety oversight, and innovation potential in crane service organizations.

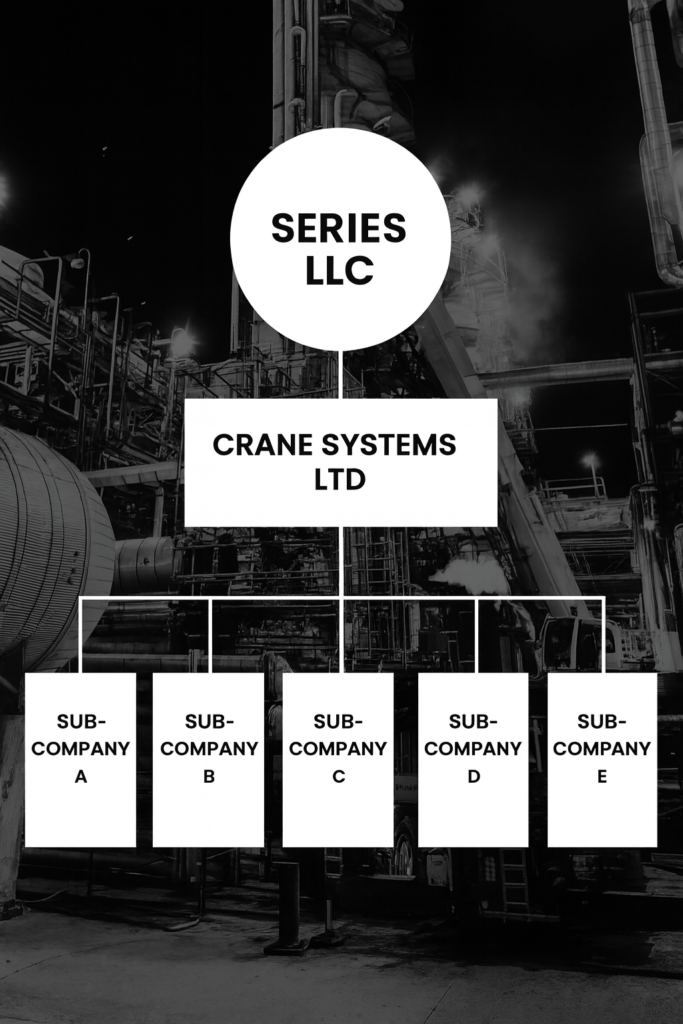

The effectiveness of crane operations is shaped not only by technical capability in the field but also by the structural design of the company that supports those operations. One advanced model recognized for its potential to influence safety, efficiency, and reliability is the series limited liability company (Feldman, 2024). This legal configuration, although not widely adopted in the crane industry, provides a framework with distinct advantages for organizing operational units (FlabizLaw.org, 2024).

In a series limited liability company, the corporate entity is composed of multiple sub-companies that exist as separate legal divisions under a single umbrella. Each sub-company maintains its own assets, liabilities, resources, and oversight, yet all share a unified governance structure (Oberloh, 2016). As Blake (n.d.) observes, the segmentation of operations in this model is designed to enhance organizational clarity while preserving strategic flexibility. This arrangement is intended to enable each operational segment to function independently with its own dedicated resources and compliance systems.

Such a structure is designed to provide complete separation of liabilities and operational challenges. If circumstances affect one sub-company, the others can remain unaffected, preserving the integrity of the larger organization (Journal of Accountancy, 2009). This separation could, in theory, support uninterrupted service continuity even in the event of localized issues.

The framework also lends itself to the development of specialized safety and compliance programs for each sub-company. Modeled on established industry governance practices, including those used by leading industrial operators, the structure supports alignment with OSHA standards, subcontractor vetting protocols, and performance metrics tailored to the specific scope of each unit (Feldman, 2024).

A notable potential advantage is the capacity for expedited decision-making. With management authority vested in each sub-company, operational adjustments can occur without delays common to more centralized systems (Oberloh, 2016; SSRN, 2024). In practice, this could allow for immediate responses to evolving conditions on a project site.

Furthermore, the modular nature of the series LLC makes it possible to integrate new service capabilities or technologies into a single sub-company without reconfiguring the entire organization. As noted by SSRN (2024), this adaptability not only facilitates innovation but also confines experimental initiatives to a controlled segment, minimizing systemic risk.

While the extent to which this model is applied will vary from one organization to another, the underlying architecture demonstrates how corporate design can be used strategically to align operational goals with structural safeguards (FlabizLaw.org, 2024). In industries where the margin for error is minimal, such considerations move beyond theoretical exercises and into the realm of practical risk management.

References

Blake, J. D. (n.d.). Structuring Series LLCs for diverse business purposes. Business and Commercial Law Journal. https://via.library.depaul.edu/cgi/viewcontent.cgi?article=1064&context=bclj&httpsredir=1

Feldman, S. (2024). The series LLC: An organizational structure that can help mitigate risk. Wolters Kluwer. https://www.wolterskluwer.com/en/expert-insights/the-series-llc-an-organizational-structure-that-can-help-mitigate-risk

FlabizLaw.org. (2024). Series LLCs: Structure, benefits and implications. Florida Business Law Section. https://flabizlaw.org/member-articles/series-llcs-structure-benefits-and-implications

Journal of Accountancy. (2009). Series LLCs: Pros and cons of a growing trend. American Institute of Certified Public Accountants. https://www.journalofaccountancy.com/issues/2010/jan/20092340

Oberloh, H. (2016). The series LLC: Further limiting liability within the LLC. South Dakota Law Review, 61(1), 142–170. https://red.library.usd.edu/cgi/viewcontent.cgi?article=1314&context=sdlrev

SSRN. (2024). Series LLCs: Statutory ambiguities, potential litigation, and clarifying legislation. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4840831

Leave a Comment